The relevant legislation for the following measures was passed and gazetted on 25 May 2017 and 2 June. Get expert guidance and get prequalified for an IRS Tax Forgiveness Program.

Relief Under Section 89 Taxability In Case Of Arrear Of Salary Relief Salary Case

Premium Tax Filing Software Makes It Easier Than You Think.

. Ad Tax forgiveness experts are ready to help you leave your tax issues behind. These are for certain activities or behaviors that the. Ad See If You Qualify For IRS Fresh Start Program.

The basis period of the tax year and with a view to making a profit. No Fee Unless We Can Help. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time.

Immediate Permanent Tax Relief. The tax rebate is calculated based on the. 5 Best Tax Relief Companies of 2022.

End Your Tax Nightmare Now. Pay less tax to take account of money youve spent on specific things like business expenses if youre self-employed. End Your Tax Nightmare Now.

Tax relief means that you either. 22 AUGUST 2016 GROUP RELIEF FOR COMPANIES PUBLIC RULING NO. In his 2017-18 Budget the Financial Secretary proposed a number of tax measures.

In Budget 2020 an additional lifestyle tax relief for the purchase of personal computer smartphone or tablet for self spouse or child was added and extended to Year of. Need to Amend Your Tax Return. Mrs Ang is a Singapore tax resident for the Year of Assessment YA 2022 and her chargeable income computation for YA 2022 is as follows.

Effective from 6 April 2017 2 Index. Date of the original notice of assessment to request an adjustment to an assessment issued for a previous tax year. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Free Case Review Begin Online. Direct Tax SPECIFIC TAX RELIEF OF RM2000 FOR INDIVIDUAL RESIDENT TAXPAYERS FOR THE YEAR OF ASSESSMENT 2015 -- INCOME TAX EXEMPTION ORDER 2016 PUA402016. 50 of tax payable up to 200.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. The 2016 tax assessment year follows the calendar year so it is effective from 1st January 2016 to 31st December 2016. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per.

For individuals without business source the due date is on or before. CLAIM FOR TAX CREDITS ALLOWANCES AND RELIEFS FOR THE YEAR ENDED 31 DECEMBER 2016 SELF-ASSESSMENT FOR THE YEAR ENDED 31 DECEMBER 2016. It is the deduction of a certain amount for money expended in that assessment year from the total annual income.

Section 138A of the Income Tax Act 1967 ITA provides that the Director General. Find Out Now For Free. Based On Circumstances You May Already Qualify For Tax Relief.

Taxpayers can start submitting their income tax return forms for the. 5 Best Tax Relief Companies of 2022. Year of Assessment 2016 No.

On Income tax Reliefs. Self and Dependent. Amount of tax rebate.

Get tax back or get it. Ad Step-by-step Instructions to Help You Prepare and File Your Tax Amendment. 20 of tax payable up to 500.

Achieve Your Goals By Using The Right Services Subject Expertise For Your Business. Ad Apply For Tax Forgiveness and get help through the process. Employment Income of Mrs Ang.

As of January 1 2016 a testamentary trust that is not a graduated rate. The 2015 tax assessment year follows the calendar year so it is effective from 1st January 2015 to 31st December 2015. Ad Trusted A BBB Member.

Amount of tax rebate. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. 2016-17 Self Assessment Tax Returns Published May 2017.

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Assessee Obligation Under Income Tax Act Taxact Income Tax Tax

Changes In Income Tax Return Forms For The A Y 2015 16 Read Full Info Http Www Accounts4tutorials Com 2015 08 Key C Income Tax Return Income Tax Tax Return

Pin By The Taxtalk On Income Tax Prove It Sourcing Credits

Tax Refund In 2021 Tax Refund Tax Return Tax Accountant

A Notice Of Assessment Or Noa Is A Statement From The Canada Revenue Agency Notifying The Taxpayer Of The Amount Of Tax They Assessment Tax Credits Income Tax

The Season For Income Tax Returns Is Around The Corner And You All Must Be Gearing Up To File Your Income Tax While Fi Income Tax Income Tax Return Tax Return

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Pin By Ca Services Online On Ca On Web Income Tax Return Tax Return Income Tax Return Filing

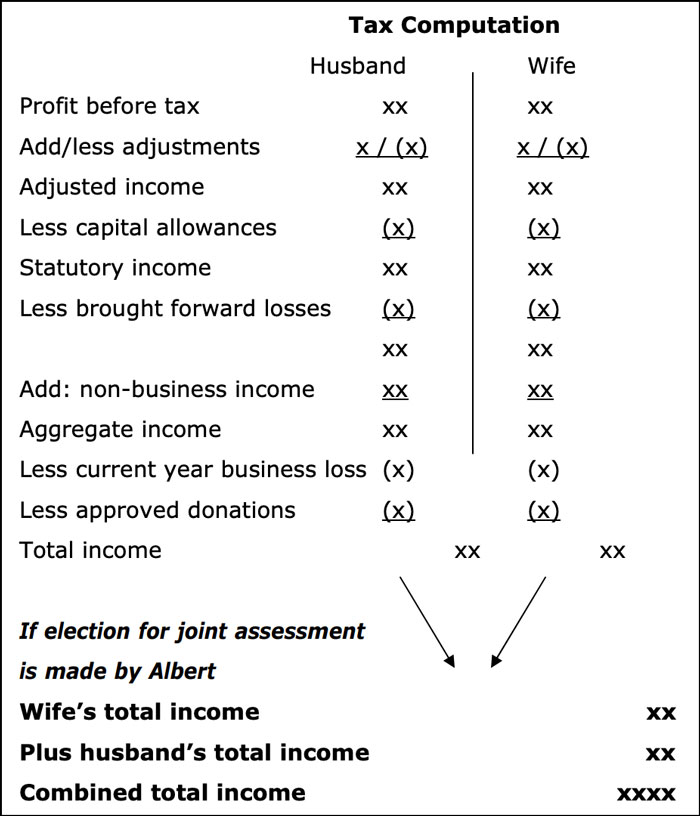

Joint And Separate Assessment Acca Global

Income Tax Slab Rates For A Y 2017 18

Retirement Of Salaried Taxpayers Exemption Deduction Relief Against Compensation Deduction Compensation Relief

All 7 Itr Forms Released For E Filing Income Tax Department The Central Board Of Direct Taxes Had Notified The New Income Tax Income Tax Return Filing Taxes

Income Tax Slab Rates In India For F Y 2018 19 For Super Senior Citizen Income Tax Income Tax

Irs Letter 2566 Proposed Individual Tax Assessment H R Block

Allan J Wilson Difference Between An Income Tax Rectification Request And Revised Return Income Tax Income Income Tax Return

Notice Of Assessment Expert Fiscaliste

Government Hands Out 1 6bn Of Tax Credits By Mistake Tax Return Tax Credits Personal Savings